Introduction: The Maturity Gap in Public Sector AI

In Q1 2025, public sector leaders across Australia, New Zealand, Canada, and the United States confronted a widening gap: AI tools are proliferating—often informally—yet the governance, interoperability, and workforce foundations needed to scale them responsibly remain uneven.

Research Innovation Council roundtable discussions across 10 jurisdictions revealed a consistent reality: while shadow tools and narrow AI pilots abound, few agencies have translated experimentation into cohesive, risk-calibrated strategies.

This digest distils the most critical insights from these discussions and proposes a shared forward playbook—not just for AI, but for the broader digital transformation infrastructure required to support it.

Patrick Joy | Head of Research & Advisory | Public Sector Network

Shadow AI Is Already Embedded—Governance Is Playing Catch-Up

Across both ANZ and NA, informal use of tools like ChatGPT, Gemini, and Microsoft Copilot is now routine—even where formal adoption hasn't occurred. A soundbite from British Columbia's briefing, revealed agencies reporting over 8.8GB of unsanctioned uploads to GenAI tools. Similar shadow usage patterns were echoed in Arizona and Victoria.

“AI isn’t coming—it’s already embedded. The question now is how safely and strategically we’re managing it.”

What’s Emerging:

- Champion-led, "safe to fail" experimentation models

- In-house AI sandboxes to reduce unsanctioned use

Risks:

- Lack of procurement guidance leaves staff exposed to T&Cs around data use, training, and deletion

- Use of tools without oversight undermines explainability, provenance, and public trust

2. Procurement Is the New Governance Battleground

Whether in Atlantic Canada or Western Australia, agencies expressed a universal pain point: procurement processes remain slow, opaque, and poorly suited to emerging technology lifecycles.

In the likes of Pennsylvania and NSW, leaders stressed the need to move from policy rhetoric to enforceable guardrails embedded in contracts, workflows, and infrastructure.

What’s Emerging:

- “AI Procurement 101” models: shared templates, risk registries, and red flag guides

- Modular procurement reforms supporting outcome-based contracting

- Open calls for startup-friendly, cross-agency purchasing pathways

Risks:

- Vendor lock-in with global platforms (esp. Microsoft, AWS)

- Approval cycles lagging behind the speed of product iteration

- Fragmentation in T&Cs interpretation leads to governance inconsistencies across portfolios

3. AI Literacy: From Executive Awareness to Workforce Fluency

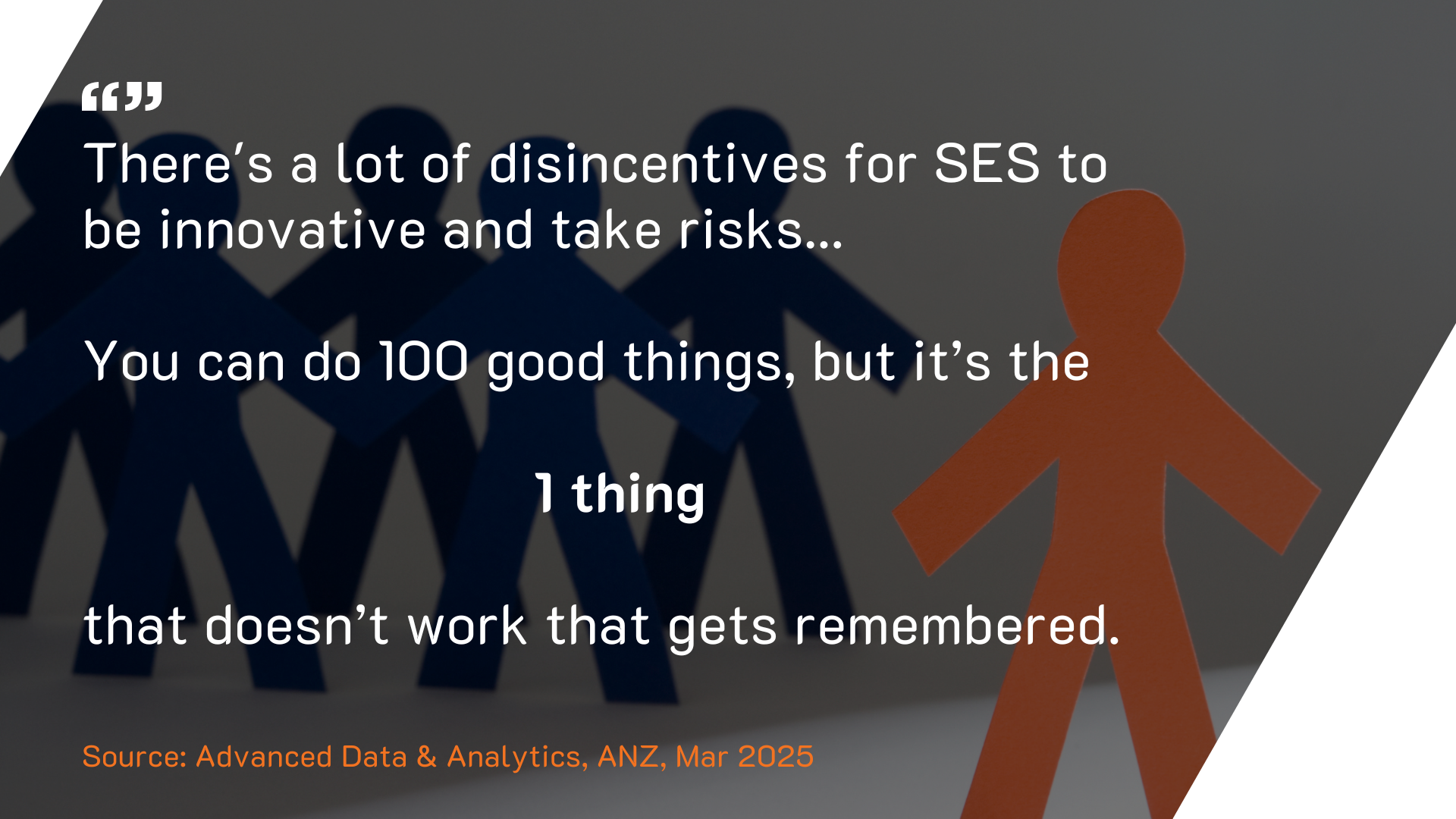

Q1 revealed a sharp disparity in AI capability: while some executives are championing innovation, many frontline and mid-level managers remain under-equipped.

WA, ACT, and Arizona all reported cultural resistance, often stemming from capability gaps, lack of training, or fear of job loss.

What’s Emerging:

- AI “bootcamps” for non-technical staff

- Student-led pilot development and “living labs”

- Executive education initiatives focused on risk, procurement, and ethics

Risks:

- Shadow use rises when formal tools are gated or poorly understood

- AI misuse may undermine trust without contestability and explainability measures

- Middle-management inertia emerging as a persistent transformation barrier

4. From Pilots to Platforms: Scaling Needs Strategy

While isolated use cases are delivering value—such as AI in contract redaction, predictive HVAC maintenance, or FOI triage—few have transitioned from pilot phase to platform-level capability.

California’s digital ID, student learning AI pilots, QChat: Queensland Government's AI-powered assistant, and the list goes on, demonstrate what’s possible when systems thinking and public-centred service design converge.

What’s Emerging:

- Cross-sector FOI automation pilots

- Agentic AI experimentation (licensing bots, document routing)

- Inter-agency showcases supporting pilot standardisation and reuse

Risks:

- Silos hinder reuse; infrastructure remains inconsistent

- Legacy systems are not yet agile enough for real-time, cross-jurisdiction implementation

- Procurement cycles risk outpacing the shelf life of the technologies they attempt to acquire

5. Digital Identity and Sovereign Capability: Quiet Foundations with Big Impact

Although less headline-grabbing than AI, both Digital Identity and sovereign infrastructure emerged as foundational enablers—and limiters—of progress across regions.

What’s Emerging:

- California’s mobile driver’s licence app now boasts over 1.2 million users, but faces interoperability barriers

- Multiple states are calling for investment in domestic compute and data sovereignty infrastructure, in tandem with aligned technical and regulatory standards for cross-agency integration

- Federated ID models in Canada are being explored as trust-first alternatives to centralised ID

Risks:

- Public trust is contingent on transparency, opt-in design, and privacy controls

- Limited GPU and sovereign infrastructure is slowing local model training and experimentation

- Vendor lock-in constrains flexibility and limits capacity to shape procurement on public sector terms

6. Human-Centred Service Design: The Missing Capability Layer

From California to Canberra, human-centred design (HCD) was identified not just as a delivery tactic, but as a strategic capability that too often goes underdeveloped.

What’s Emerging:

- Piloting AI-powered assistants within controlled, human-in-the-loop settings

- Embedding user research in procurement and delivery lifecycle documentation

- Public value and equity being reframed around access equivalence, not just digital channels

Risks:

- HCD remains underfunded, often added as an afterthought rather than designed in from the outset

- Legacy regulation and siloed service responsibilities impede cross-channel journeys

- Without meaningful HCD capability, governments risk deploying fast tech into slow systems

7. AI Governance Must Be Explainable, Auditable, and Human-Centred

Public trust remains the defining constraint. Leaders in NSW, Victoria, and Pennsylvania repeatedly highlighted the need for transparency and contestability in high-stakes use cases—particularly those affecting licensing, eligibility, or enforcement decisions.

What’s Emerging:

- Explainability by design: dual-output models, evidence-trail traceability

- Cross-agency AI governance boards

- Vendor accountability clauses tied to auditability and transparency

Risks:

- Overlapping reforms (cyber, privacy, ethics) causing “decision paralysis”

- AI decisions that cannot be challenged or understood erode long-term legitimacy

.png)

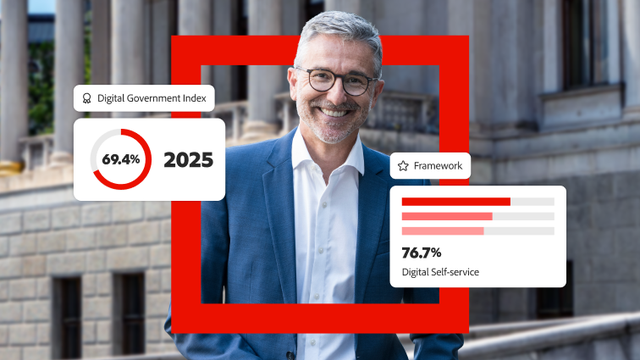

Shared Strategic Priorities for 2025

Across jurisdictions, consensus is forming around several imperatives:

✅ Move from ethics to enforcement: Embed AI and data guardrails into procurement, regulation, and training

✅ Build sovereign capability: Invest in domestic infrastructure, open models, and procurement leverage

✅ Scale executive fluency and workforce literacy

✅ Modernise procurement to be modular, transparent, and outcome-driven

✅ Design for trust: Prioritise contestability, explainability, and inclusive service experiences

Final Reflection: Does Digital Government Hinge on Trust?

The first quarter of 2025 made one truth plain: AI is already a daily reality for public servants. But its long-term success hinges on a collective shift—from informal, tool-driven experimentation to structured, system-wide strategies that privilege transparency, inclusion, and capability.

Procurement, Digital ID, human-centred design, and sovereign infrastructure aren’t tangential—they are the preconditions for trustable technology.

The institutions that succeed won’t just adopt AI. They’ll transform how they design, govern, and deliver digital public value—with citizens at the centre.

💬 Where did these perspectives come from?

Read more about Public Sector Network's Research Innovation Council