Australia and New Zealand’s public sectors have long embraced digital government as a national priority, positioning themselves as leaders in citizen-centric digital services. However, despite strong strategic intent, significant structural and operational barriers are siloing teams and fragmenting processes, continual hindrances to cross-agency collaboration, data-sharing, and whole-of-government coordination—core pillars of modern digital governance.

This article explores the interplay between executive priorities and execution capabilities, highlighting benchmarking data from Public Sector Network Innovation Surveys and the OECD Digital Government Index to quantify the impact of fragmented collaboration and limited open data adoption across ANZ’s digital government landscape.

Systemic Barriers Impacting Digital Government

Despite 40% of ANZ digital government executives identifying cross-agency and cross-sector collaboration as the No. 1 change needed for government to meet public expectations, only 11% of the same sample have prioritised collaboration in their 12–24 month strategic plans.

What do you believe is the No. 1 change that can help Government meet expectations? (797 respondents)

40%: Cross agency and cross sector collaboration (top result)

12%: Improved data democratisation and utilisation (5th place)

What is your organisation, department or function’s top priority over the next 12-24 months? (659 respondents)

25%: Transforming and automating processes (top result)

11%: Collaborating with other departments/ tiers of government (5th place)

Survey Snapshot Only, Full results were published in (State of the Service Australian Innovation 2024).

Further discrepancies emerge when considering the enablers of collaboration—open data and data-sharing. In the same poll, open data ranked four places lower than collaboration, with only 12% of the same digital government executives recognising data democratisation and utilisation—the core building blocks of cross-sector partnerships—as a top challenge.

A deeper look at OECD benchmarking better quantifies this lack of alignment between executive intent and execution capacity, highlighting how Australia and New Zealand are underperforming in open government and data-sharing—two critical enablers of collaborative, digital-first governance.

ANZ ranks 21st (AUS) and 30th (NZL) in Open by Default within the OECD Digital Government Index (DGI), exposing a gap between transparency ambitions and execution.

ANZ significantly underperforms in Open, Useful, and Reusable Data (OURData), ranking 28th and 29th out of 36 OECD countries, signalling fundamental weaknesses in data accessibility, interoperability, and public sector innovation.

Risks of Underperformance in Open Government and Open Data Capabilities

1. Transparency & Trust Deficit

Open by Default and Open Data policies enable citizen engagement, accountability, and policymaking participation. Without them, engagement tools like participatory budgeting and public consultations become ineffective.

Low transparency in government AI usage risks biased or flawed models, undermining public trust in fairness and accountability.

Weak AI governance and opaque automation processes increase ethical risks, including discrimination, privacy breaches, and reduced human oversight in decision-making.

2. Innovation & Economic Losses

Open government data is a driver of economic growth, supporting AI-driven services, new digital tools, and business models. Failure to leverage public sector data limits digital economy potential.

Countries like Denmark, Estonia, Singapore, and South Korea have successfully harnessed open data for AI development, digital services, and competitiveness.

Limited interoperability with international open data standards restricts participation in global digital collaboration, cybersecurity, and digital trade initiatives.

3. Operational Inefficiencies

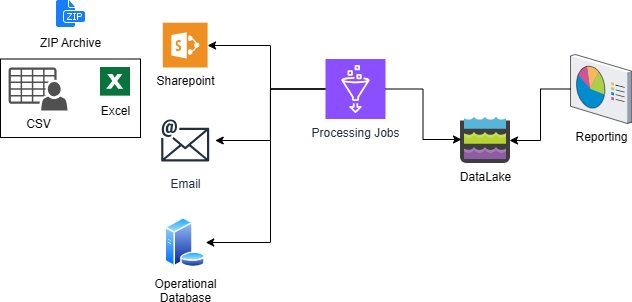

Weak Open by Default mechanisms hinder cross-agency data-sharing, leading to siloed systems, platform duplication, and slow response times.

A lack of machine-readable, interoperable datasets constrains evidence-based policymaking and real-time crisis response.

Poorly integrated cybersecurity and risk management frameworks increase vulnerabilities, regulatory compliance gaps, and administrative burdens.

Closing the Gap: From Strategic Intent to Execution

While Australia and New Zealand have made significant strides in digital government, persistent gaps in collaboration, open data adoption, and cross-sector integration threaten to stall progress. Without targeted action to bridge the divide between executive priorities and execution capabilities, the promise of citizen-centric, data-driven governance will remain unrealised.

To drive meaningful change, public sector leaders must shift from high-level commitments to measurable, scalable reforms—strengthening open data frameworks, embedding interoperability into digital infrastructure, and prioritising collaborative governance as a key performance metric.

The path forward requires a recalibrated approach: one that aligns policy ambitions with the technological, operational, and cultural levers necessary for execution. By embracing structured data-sharing, whole-of-government coordination, and transparent AI governance, ANZ’s digital government ecosystem can unlock the full potential of innovation-driven public service delivery.

This article is just the starting point. Our forthcoming whitepaper on Systems of Work will present actionable strategies, case studies, and policy recommendations to help government leaders turn intent into impact. Stay tuned as we explore the solutions that will define the next era of digital governance.

Acknowledgement

This research was supported by Atlassian, whose longstanding commitment to empowering collaboration and driving innovation across complex systems played a critical role in shaping this analysis. Atlassian’s leadership in modern work management and digital enablement reflects the strategic imperatives explored in this article—especially the need for greater cross-agency coordination, open data practices, and scalable, interoperable platforms in the public sector through systems of work. Through its globally recognised collaboration tools and expertise in transforming ways of working, Atlassian continues to support governments in bridging the execution gap and realising the full potential of digital-era public service delivery.

Published by

About our partner

Atlassian | Highway Three

Atlassian unleashes the potential of every team. Our agile & DevOps, IT service management and work management software helps teams organise, discuss, and complete shared work. The majority of the Fortune 500 and over 300,000 companies of all sizes worldwide - including NASA, Audi, Kiva, Deutsche Bank and Dropbox - rely on our solutions to help their teams work better together and deliver quality results on time. Learn more about our products, including Jira, Confluence and Jira Service Management at https://atlassian.com/

Learn more